NFT Use Cases

Date: 15 March 2023

Author: Gaya Chandrasekaran

In this article we try to address the fundamental question of ‘why NFTs’. Critics believe NFTs don’t create real value so we take a sneak peek into what drives the underlying value for an NFT in the wider context of its suite of applications.

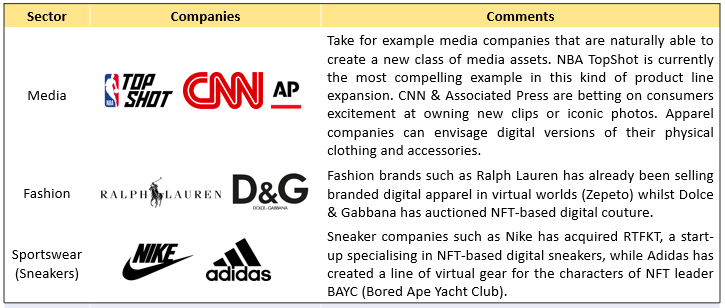

Next, we explore the relevance of NFTs in the context of brand management with a few industry examples. Some sectors find it more straightforward to use NFTs to promote their brand and take control of engagement with their customers.

NFTs started off as collectibles but have gone on to become digital product line extensions; they are also fast becoming the basis for a multifaceted digital consumer connection. But how far away are we from brands realizing the true potential of NFTs? A few years at the very least.

We then explore the potential impact of NFTs in the DeFi ecosystem through new opportunities in loan collateralization, fractional ownership, insurance, debt management and KYT & compliance.

Here again, we are a few years away from realizing the full benefits as the adoption of web3 has been slower than web1 & web2.

Have you wondered why NFTs – do they even create value?

At a quick glance, it becomes obvious that NFTs have made two things possible – establishing verifiable digital ownership and expanding use cases through its core feature of programmability.

- Previously it has been difficult to establish true ownership of a digital artwork however NFTs address this issue as they represent a receipt of ownership. Thus they have created new markets where erstwhile such transactions did not exist.

- NFTs being programmable can be endowed with features that help expand their purpose or uses over time – they can be used as entry tickets for events or online spaces, cards representing membership, special discounts, exclusive access or rewards. Such uses provide additional value to holders and equip creators with the ability to build community engagement around their brand.

Underlying value of NFTs is embedded in the community one builds around them – the higher the engagement, greater the value.

How do Brands use NFTs?

What started off as collectibles has gone on to become digital product-line extensions for some companies. Launching NFTs have helped them expand product lines into the metaverse, adding a new angle to how consumers engage with and experience the brands.

Such product line extensions are more natural for some companies than for some others such as media, fashion and sportswear.

NFTs are fast becoming the basis for a multifaceted digital consumer connection. While NFTs are mostly being used for unique digital assets, the underlying technology could just as well identify a unique experience (the fact that you attended an event, for example) or a unique physical-world object.

It’s a question of how companies use the digital identifier that forms the basis for each NFT’s assertion of uniqueness and authenticity.

Nike’s 2019 CryptoKick patent connects a physical pair of shoes to an NFT-based virtual twin, setting up a future in which owners of multiple sneaker NFTs might even “breed” them into custom kicks. Emerging technologies like those from Veracity Protocol help with creation of digital identifiers encodable into an NFT derived from actual physical items.

Such NFT-encoded digital identifiers create exciting new possibilities for brands and consumers as they can tap into a whole host of real-world purchase and consumption experiences that can be brought into the digital space.

NFTs can also revolutionize secondary market for these physical items – the digital seal of authenticity for a physical item creates a more seamless trust in resale also allowing brands to incorporate a small fraction of value capture associated with every resale more formally (i.e., royalty, a programmable feature of NFTs).

NFTs & Brands – Future Path

Web3 is developing more slowly than Web1 and Web2 as a commercial technology infrastructure because some communities are trying to actively resist the centralised coordination that can accelerate adoption and the evolution. As such, the true brand possibilities of NFTs are likely to take a few years to realize.

However, brands should get started to ensure they do not fall behind the rest of the market. Obvious first step is to explore digital collectibles by tying them to the brand or core product (example, Nivea’s NFT to explore the ‘value of touch’).

Brand perception can also be enhanced with a philanthropic dimension such as ‘donating proceeds of NFT drop to charity’. At this stage it is all about trial and error for brands to see what works best for them – the eventual audience is the universe of existing and future customers, not just today’s crypto community.

NFTs & the DeFi ecosystem

What is DeFi? According to Investopedia Decentralized finance, or DeFi, uses emerging technology to remove third parties and centralized institutions from financial transactions.

The components of DeFi are stablecoins, software and hardware that enables the development of applications. The infrastructure for DeFi and its regulation are constantly evolving.

NFTs can potentially impact the DeFi ecosystem significantly by offering new opportunities in loan collateralisation, fractional ownership, insurance, debt management and KYT & compliance.

- Loan Collateralization: As NFTs have become an asset class that can no longer be ignored, they are being used as collateral. The borrower lists their NFT and lender makes an offer after running a fair assessment of the NFT’s value, the loan-to-collateral ratio, the length of the term and the interest rate.

The borrower can accept the offer and this is when funds from the lenders are received while the NFT is locked as collateral. This entire process happens in one transaction on the blockchain, its ‘trustless’ i.e., there is no counterparty risk (that an NFT will be sent without the borrower receiving funds and vice versa).

Also, the health of the loan is continuously monitored by smart contracts – if the borrower fails to repay the lender by the term of the loan, the escrow smart contract will automatically transfer the NFT collateral to the lender’s wallet.

Alternatively, when the borrower repays the loan in whole, the NFT is automatically unlocked and returned to the borrower’s wallet upon which the promissory note token is burnt.

Benefits: eliminates risk of lender discrimination, ensuring the borrower can obtain fair market terms on their collateral no matter their demographic or financial standing. For lenders, it mitigates risks in case of default as the collateral seizure happens automatically. Overall, the cost and transaction time reduces.

- Fractional Ownership: A fractional NFT is one which is divided into smaller fragments and owned by multiple parties. Smart contracts make it possible to define the number of tokens linked to an original indivisible NFT.

Fractional ownership aids equity by reducing capital barriers to entry and improves liquidity as the fractional ownership is not chunky and is easier to be sold on the secondary markets.

- Insurance: NFTs provide a reliable way to prove ownership and prevent tampering with insurance policies given they are immutable and the data on the blockchain itself is transparent and verifiable.

The entire insurance policy underwriting and purchase process involving cumbersome paperwork traditionally, can be streamlined through NFTs. NFTs can also help prevent fraud in the case of claims through use of smart contracts that can be verified for claims payout.

- Debt Management: Smart contracts can be used to make calculations and automatically execute required actions, reducing time spent and human error. All data stays on ledger which can be continuously verified and tracked.

- KYT and Compliance: Verifying identity of all parties involved in a transaction can reduce fraud and criminal activity. NFT containing the stored identity data can be shared instead of running an identity verification process every time.

There are however two main challenges in terms of implementing NFT technology within DeFi – the volatility of the NFT market and the security concerns associated with the assets.

Technology solutions to protect users and DeFi platforms exist but until users & platforms are more aware of these solutions and implement them, wider adoption might remain constrained.

In conclusion there is no denying the benefits of using NFT technology in the decentralized world but realizing its full potential in this space is again going to take time.

From the above it is evident that NFT use cases go beyond digital art and have been evolving and expanding with time. NFTs are touted as the next level of CRM through its ability to foster and enhance community engagement.

In the next few articles I will bring to the readers specific case studies of brands using NFTs. The uses are so varied that it becomes worth doing a quick analysis on key developments in the industry (see below for a few examples). We will dive into the ‘how’ and ‘why’.

- Since Dec-21, Nike has earned $185m in NFT sales revenue and has generated $1.3bn in NFT sales volume. Nike has made 8x more in revenue than the brand having the second greatest revenue (D&G at ~$23m).

- The European Union plans to combat counterfeiting of real-world goods by developing a strategy that would use blockchain technology and NFTs by 2023.

- The City of Miami was launching 5k ethereum-based NFTs late last year in partnership with Time USA (to help define the city’s NFT strategy), Mastercard (to offer eventual holders exclusive benefits like special event access at restaurants, and Salesforce (to manage the minting and primary sales process through its NFT cloud platform). The unique NFTs are being designed by 56 different Miami artists, to represent the city’s 56 square mile area.

Please note the opinions expressed within the content are solely the author’s and do not reflect the opinions and beliefs of people, institutions, or organizations that the owner may or may not be associated with in a professional or personal capacity.

References

- How NFTs Create Value’ by Steve Kaczynski and Scott Duke Kominers, HBR (Nov-21)

https://hbr.org/2021/11/how-nfts-create-value#:~:text=In%20this%20sense%2C%20NFTs%20can,can%20engage%20with%20each%20other. - ‘How your brands should use NFTs’ by Arun Sundararajan, HBR (Feb-22)

https://hbr.org/2022/02/how-your-brand-should-use-nfts - ‘Five ways NFTs can drive institutional adoption & streamline processes’, by Anthony Georgiades, Forbes (Mar-23)

https://www.forbes.com/sites/forbesfinancecouncil/2023/03/07/five-ways-nfts-can-drive-institutional-adoption-streamline-processes/?sh=61a5f3b84de1 - ‘How Nike won with NFTs’ by Covalent (Feb-23)

https://www.covalenthq.com/blog/how-nike-won-with-nfts/ - ‘European Union plans to combat counterfeiting with NFTs by 2023’ by Finbold (Sep-22)

https://finbold.com/european-union-plans-to-combat-counterfeiting-with-nfts-by-2023/ - ‘City of Miami to drop 5k NFTs with Time, Mastercard & Salesforce’ by NFT Evening (Jul-22)

https://nftevening.com/city-of-miami-to-drop-5k-nfts-with-time-mastercard-salesforce/

About the Author

Gaya works in the Global Digital Solutions Group (DSG) within Santander Corporate & Investment Banking (SCIB), which focusses on developing innovative, sustainable and profitable digital capabilities and providing state of the art advisory services to clients. She joined Santander in 2014 gaining broad experience across Corporates & FIG in SCIB and has also worked on several strategic initiatives including regulatory deliverables. Her work involved deal structuring, due diligence and portfolio management. During this period, she has won awards and nominations to Accelerating You Programme for Future Leaders and Global Risk Leadership Programme.

Gaya recently completed the Fintech Programme from Oxford University. She holds a Masters in Finance from London Business School (Recipient of Graduating Student Award) and an MBA (Gold Medallist) from India.

She has contributed actively to alumni engagement at LBS since graduation through several leadership positions, most recently as an ExCo Member of London Alumni Club where she led events on identifying fintech winners, cyber risk, sustainability & factor investing involving C-suite speakers, industry experts and faculty. Gaya is a Mentor and the Head of Personal Excellence Programme (PEP) for London with Women in Banking & Finance (WIBF). She is passionate about supporting women in their ambitions and enjoys organizing knowledge-sharing networking events.

Outside her day job, Gaya is a self-taught artist and has been influenced by art right from her early childhood. She loves learning new techniques and underwent training in India as well as in the UK (Slade School of Art). Her choice of themes are inspired by key life moments. An expression of her thoughts and emotions, her artworks invite the audience to go deep within, explore and connect with their own experiences. Gaya offers NFTs in lieu of a Certificate of Authenticity to all her collectors – its her mission to facilitate digitisation to her audience. Based on feedback from a renowned NFT Collector she is now exploring software tools to mint NFTs of pure digital artworks.

Gaya’s first solo exhibition was in 2018 at Santander’s London office, a fundraiser where she sold >70% of artworks donating 50% of proceeds to charity. Her painting, ‘The Golden Lion’ won a special commendation in the David Shepherd Wildlife Foundation’s #sketchforsimba competition in 2019. She conceptualised the first ever Art Exhibition within the LBS community, which led to LBS Art Week in 2021 where her paintings were selected for the online exhibition and she was a chosen speaker of the Artists Panel. She exhibited her artworks with The Holy Art Gallery and The Boomer Gallery in London during 2022. Her artworks are published in the Artist Talk Magazine Issue 22 & 23.

“Please note the opinions expressed within the content above are solely the author’s and do not reflect the opinions and beliefs of people, institutions, or organisations that the owner may or may not be associated with in a professional or personal capacity.”